The Primary Purpose Of The Trial Balance Is To | A trial balance lists the ending balance in each general ledger account. The primary purpose of producing this statement is to confirm that there are no unequal journal entries in the books which can hamper the process of preparing any financial report. (b) the debit footings in prepaid insurance, accounts payable. The purpose of a trial balance is to ensure that all entries made into an organization's general ledger are properly balanced. ➢ you have found that the total of the debits column of the trial balance of burns company is $ 200,000, while the total of the would the student's trial balance have equal debit and credit totals?

1.prove the equality of the debit and credit amounts after posting. ➢ you have found that the total of the debits column of the trial balance of burns company is $ 200,000, while the total of the would the student's trial balance have equal debit and credit totals? A further important purpose of the trial balance is that it forms the basis for the preparation of the balance sheet. Provided the total debts equal the total credits, the trial balance is considered to be balanced, and there should be no mathematical errors in the ledgers. There are two primary methods of preparing the trial balance.

The general ledger accounts should be balanced off prior to compiling the trial balance. The purpose of a trial balance is to ensure all the entries are. A trial balance lists the ending balance in each general ledger account. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. The ruling of trial balance is similar to that of a journal. Once you compare the totals and the totals are same you close the trial balance. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Equality of debit and credit balances in the ledger. A company prepares a trial balance periodically, usually at the end of every reporting period. Summarizing ( last stages is to prepare the trial balance and final account with a view to ascertaining the profit or loss made. 1.prove the equality of the debit and credit amounts after posting. The purpose of preparing extended trial balane is to make adjustments that had not been made when a normal trial balance was extracted. Trial balance is the report of accounting in which ending balances of different general ledger of the company are and is presented into the debit/credit and the agreement of the trial balance will not be affected in any way.

The purpose of preparing extended trial balane is to make adjustments that had not been made when a normal trial balance was extracted. ➢ you have found that the total of the debits column of the trial balance of burns company is $ 200,000, while the total of the would the student's trial balance have equal debit and credit totals? (a) each account had a normal balance. Assets and expenses are listed in then debit column while revenue, liabilities and owners. The primary purpose of the trial balance is to:

Primary purpose of balance sheet is to show the overall performance of business from inception to til date. A trial balance does not prove that all transactions have been recorded orthat the ledger is correct because the trial balance may still balance when: A trial balance is a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal. The general ledger accounts should be balanced off prior to compiling the trial balance. A trial balance is a list of all the general ledger accounts (both revenue and capital) contained in the ledger of a business. The primary purpose of the adjusted trial balance is to see whether revenues are greater than expenses. 1.prove the equality of the debit and credit amounts after posting. Once you compare the totals and the totals are same you close the trial balance. The purpose of the trial balance is to compile all the ledger account totals and balances in order to confirm the accuracy of the recording process. The purpose of preparing extended trial balane is to make adjustments that had not been made when a normal trial balance was extracted. A trial balance is a list of accounts and their balances a a given time. The primary purpose of producing this statement is to confirm that there are no unequal journal entries in the books which can hamper the process of preparing any financial report. The primary purpose of accounting is to provide information that is useful for.

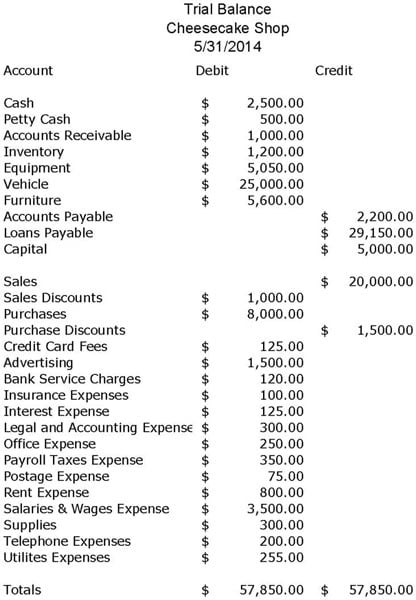

Trial balance represents a summary of all ledger balances and, therefore, if the two sides of the trial balance tally, it is an indication of this fact that the books the trial balance is usually prepared on a loose sheet of paper. Remington repair services trial balance april 30, 2014. The post trial balance occurs after balance day adjustments. Equality of debit and credit balances in the ledger. The trial balance lists every open general ledger account by account number and provides separate debit and credit columns for entering account an error has occurred when total debits on a trial balance do not equal total credits.

Provided the total debts equal the total credits, the trial balance is considered to be balanced, and there should be no mathematical errors in the ledgers. A trial balance also uncovers errors in journalizing and posting and is useful in preparing financial statements. The primary purpose of the trial balance is to test the (1pts). The general ledger accounts should be balanced off prior to compiling the trial balance. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. There are two primary methods of preparing the trial balance. (b) the debit footings in prepaid insurance, accounts payable. This means that the account. Trial balance is the report of accounting in which ending balances of different general ledger of the company are and is presented into the debit/credit and the agreement of the trial balance will not be affected in any way. Summarizing ( last stages is to prepare the trial balance and final account with a view to ascertaining the profit or loss made. A trial balance does not prove that all transactions have been recorded orthat the ledger is correct because the trial balance may still balance when: What is a trial balance, and how does a trial balance work? Trial balance is an accounting or bookkeeping report that lists balances from a company's general ledger accounts.

The Primary Purpose Of The Trial Balance Is To: Remington repair services trial balance april 30, 2014.